Jul 25, 2024 in Technology

AI-Powered Compliance: The Future of Financial Crime Prevention for Banks and Fintechs

In an era where financial transactions are becoming increasingly digital, the role of third-party payment processors and financial crime compliance (FCC) providers has never been more crucial. Banks, Neo-banks, and fintech companies are navigating a complex landscape of regulatory requirements, technological advancements, and evolving customer expectations. We take a look at the market size, the need for third-party FCC providers, the risks and opportunities for banks, and how AI, particularly Generative AI, is transforming this field.

Market Size and Growth Drivers

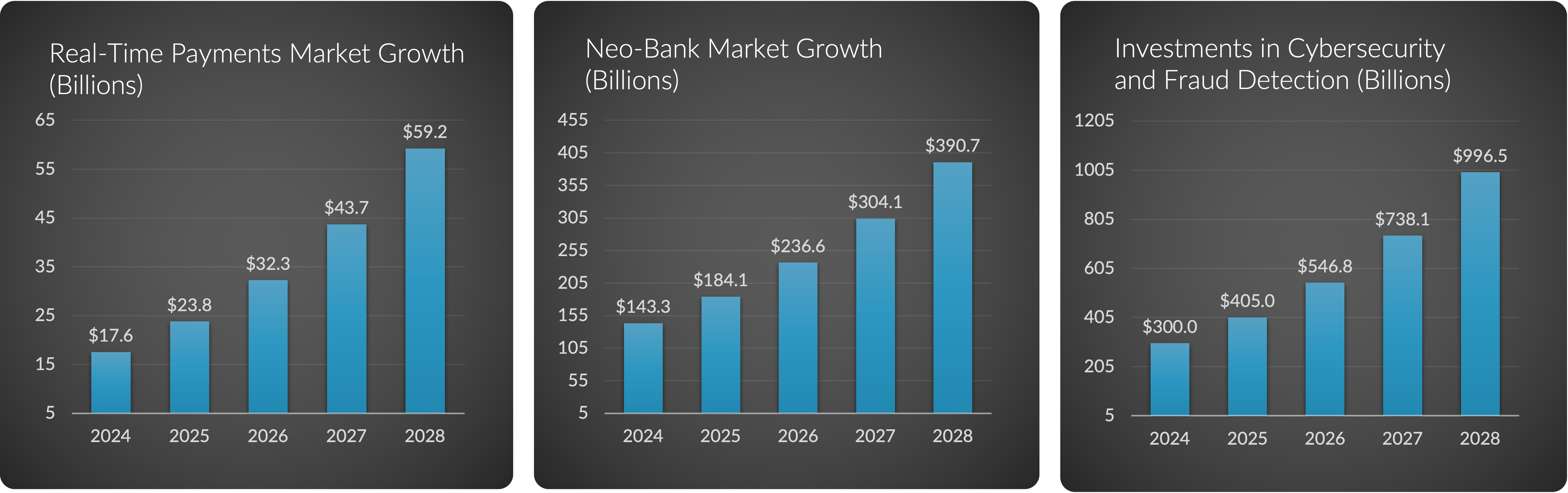

The global real-time payments market was valued at $17.57 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 35.5% from 2023 to 2030. The neo-bank market, projected to reach $143.3 billion by 2024, reflects the rapid adoption of fintech innovations and API collaborations. Additionally, investments in cybersecurity and fraud detection are set to reach nearly $300 billion by 2026, underscoring the significant financial commitment to securing transactions and ensuring compliance.

The Need for Third-Party FCC Providers

Financial institutions face mounting regulatory pressures and rising compliance costs, with compliance operations costs increasing by 98% for North American financial institutions alone, reaching $61 billion. These institutions are turning to technology and outsourcing to manage the growing complexity of financial crime compliance. A tailored compliance plan, leveraging advanced technologies such as AI and machine learning, is essential for addressing unique organizational risks while maintaining regulatory adherence.

Risks for Banks

The primary risks for banks in the current landscape include:

- Regulatory Compliance: Banks are under intense scrutiny to comply with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. Failure to comply can result in hefty fines and severe reputational damage.

- Technological Debt: Many banks struggle with outdated technology systems that hinder real-time monitoring and efficient compliance management.

- Fraud and Cybersecurity: The increasing sophistication of financial criminals and the exponential growth of digital transactions make it imperative for banks to invest in robust cybersecurity measures.

Opportunities for Banks

- Enhanced Compliance Efficiency: By partnering with third-party FCC providers, banks can leverage advanced AI-driven solutions to enhance compliance efficiency, reduce false positives, and streamline transaction monitoring.

- Cost Reduction: Automation of compliance processes through AI can significantly reduce operational costs, allowing banks to allocate resources more effectively.

- Revenue Growth: Advanced compliance solutions enable banks to introduce new products faster, improving customer satisfaction and driving revenue growth.

The Role of AI in Financial Crime Compliance

AI has been a game-changer in the financial sector, particularly in compliance and fraud detection. AI-powered platforms like Pelican provide real-time monitoring, intelligent repair, and routing using natural language processing (NLP) and machine learning (ML). These technologies enable higher straight-through processing (STP) rates, reduced processing costs, and improved payment efficiency.

The Promise of Generative AI

Generative AI, a subset of AI that involves creating new data based on existing datasets, presents exciting opportunities for financial crime compliance:

- Enhanced Fraud Detection: Generative AI can simulate various fraud scenarios, enabling banks to anticipate and mitigate potential threats before they materialize.

- Personalized Compliance Solutions: By analyzing vast amounts of transaction data, generative AI can help develop tailored compliance strategies that address specific organizational risks.

- Improved Decision Making: Generative AI can provide compliance officers with advanced analytics and insights, facilitating quicker and more informed decision-making processes.

The market for third-party payment financial crime and compliance providers is poised for significant growth, driven by increasing regulatory demands, technological advancements, and the evolving needs of financial institutions. Banks, neo-banks, and fintech companies must leverage AI and generative AI to stay ahead of compliance requirements, reduce costs, and capitalize on new revenue opportunities. By embracing these advanced technologies, financial institutions can navigate the complex compliance landscape more effectively and secure their operations against emerging financial crimes.